Is this the right time to buy gilt mutual funds?

Over the past few days, several readers have asked, “Is this the right time to start buying gilt mutual funds?”. This is because of our repeated stress on gilt funds being a suitable choice or accompaniment to EPF/PPF for long-term goals.

Let us start with the basics. Gilt mutual funds predominantly invest in govt. bonds (aka gilts because historically govt bonds were printed on gilt/gold-edged paper ). Although the credit risk in such funds is minimal (govt bonds cannot be rated for a resident investor!), the NAV of such funds will fluctuate wildly!

The longer the duration (date until maturity) of the bonds in the portfolio, the more will be the NAV fluctuations. This because of demand-supply fluctuations in the bond market. In many gilt funds (and dynamic bond funds) the fund manager will change the duration of bonds held in the portfolio as per present bond market conditions and their reading of the future. Let us refer to this as “managing duration risk”.

There two types of gilts funds” the constant maturity gilts funds that predominantly hold 10-year bonds and the “plain” gilt funds. The constant maturity funds will have an average portfolio maturity of close to 10 years at all times. Hence the volatility will be higher but since the fund manager will indulge in trying to manage duration risk, the fund is like an (expensive) index fund.

The plain gilt variety will typically have funds that will try and manage duration risk. Some will do this activity and some in a rule-based manner. As a follow up to this article, I shall discuss what to look for in a gilt fund.

Now, let us focus on the question before us: Is this the right time to buy gilt mutual funds? When should investors consider gilt funds (both types)? Only for long-term goals, a minimum of ten years away.

So if your need is 10+ years away, you do not have to worry about the “current bond market situation”. What you should worry about is, “can I really stomach gilt fund NAV fluctuations? or will I run away at the first sight of negative returns?”

If you are interested in gilt funds, please start small. Invest a small sum each month, manually or via SIP and get used to the volatility for a while and then gradually increase exposure.

It is not easy to stay invested in gilt funds but for the long-term the odds of managing the risk is acceptable. The odds of a liquid fund or money market fund being risky over the long term is high (yes, you read that right).

Investing (life) is all about identifying reasonable odds and ensuring they stay reasonable in our personal journey. When people say they fear “market risk”, they are being unreasonable and no good decision ever came out of that corner.

If you are a systematic investor or a systematic risk manager (hopefully both) then you are done. The remainder of the article is about timing entry into gilts, not relevant for the systematic investor. The only takeaway if you read it is if you start investing in gilt funds, do not expect “good returns” immediately. This is an uncertain time.

There is a second aspect to the titular question. If I wish to “time” my exit and entry into gilt funds, is this a good time to enter? We have already discussed ways (with backtesting results) in which one can time the gilt market and which of these have “reasonable odds”

Note: No timing method has worked all the time in the past and therefore no timing method will work all the time in the future. It is a question of reasonable odds of lowering risk vs returns vs tax associated with churn.

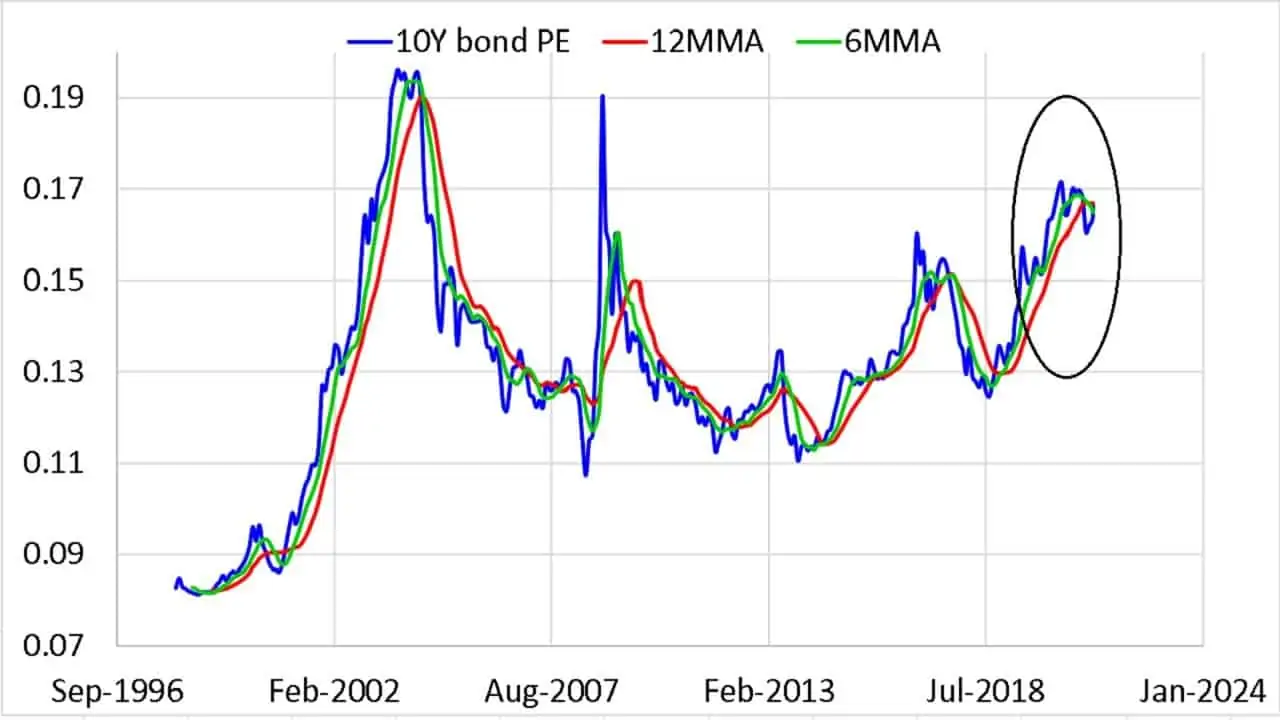

The method discussed involves looking at the gilt PE = 1/10Y-gilt-yield.

The idea to consider when the 10Y bond PE is greater than both its 6-month and 12-month moving average. This is a buy signal. The opposite, when the bond PE is lower than both the averages is a sell signal. Backtest results are available in the above-mentioned link.

The following graphs are sourced from the freefincal:

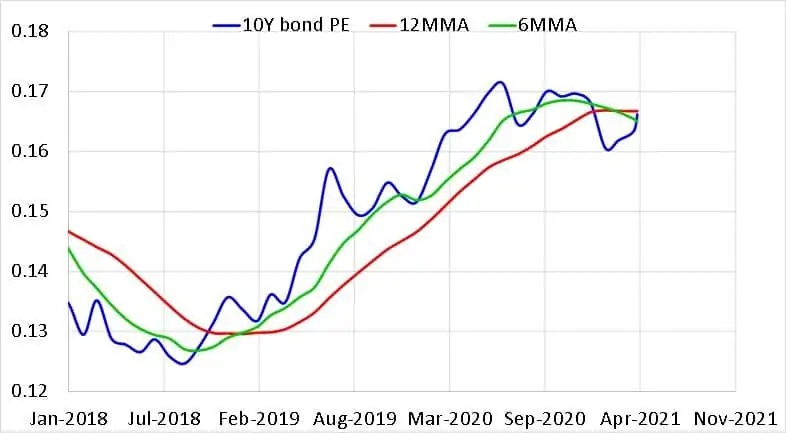

The region around the marked oval is expanded below. Notice that the bond PE was > 6MM and 12 MMA (buy zone) from late 2018 and fell down only in Jan 2021. Thanks to RBI intervention, the PE has gone back. As of 1st April, the PE was still below both averages and as of 9th April, the PE has crossed the green (6mma) line but still below the red line (12 MMA).

IF you wish to adopt a tactical strategy for gilts and IF you wish to use the above model, then at the very least it is neither a time to buy nor a time to sell. RBI keeping rates constant on April 7th has made a big difference but the uncertainty has not gone away. The govt wants bond buyers to accept existing coupon rates. The buyers want higher rates. This tug-o-war can continue for the next few months.

Comments

Post a Comment